There is a wealth gap in America that has been suggested by NYU Economist Edward Wolff to be an enormous 68 fold difference (6700%) between some economically disadvantaged and ‘advantaged’ groups.

Potentially >60X Differences In Median Wealth

Pew Research Center’s December 2014 review of FRB data shows median household wealth disparity between is 10X (900%) to 13X (1200%) different.

Wealth disparities are compounded and seemingly cemented by a myriad of contributing factors, many of which – having happened throughout American history – we can’t do much about today. We simply can’t go back in time to change laws and policies. On the same accord, for any family who is serious about doing their part to close the wealth gap, is it prudent to blindly follow popular ‘wealth building’ policies and recommendations?

What CAN’T Be Done To Close The Gap

Bridges to get us across big gaps exists… But let’s face it. When we discuss economic disparities in the order of THOUSANDS of percentage points, there are very few viable mechanisms that can be deployed to close such an enormous gap.

Here I describe three popular wealth building strategies, that SURELY will not and can not close the wealth gap.

‘Just Work More’

If the gap was only twice as big (100% or 2X) difference, closing the wealth gap could be as simple as working twice as many hours or even doubling your hourly wages.

But with 13-69X differences, no one is humanly capable of working 13 MORE JOBS, much less 60+ extra jobs! Moreover, there aren’t enough jobs openings today to hire every person who is on the disadvantaged side of the wealth gap at 10 times the pay of their wealthier counterpart.

Herein, arguably merely working an extra job WILL NOT close the gap.

‘Just Get A Degree’

There is no collegiate ‘degree’ from any accredited college in the US where its graduates earn a median salary 10 times to 69 times higher income than the majority of US population, and do so without accruing significant student loan debt.

The popular logic is often casually thrown around that ‘college grads earn more over the lifetime’ and therefore it is suggested that they have a higher net worth. This has indeed been the case when retrospectively viewing income over the last thirty years.

But for graduates today, the benefit of this logic has yet to be proven. To the contrary, due to the rising student loan debt to income ratio, this fallacious logic should be discarded and regarded as gravely inapt. Debt to income ratio for young households with collegiate education and loans, is twenty (20) times higher than young households with no collegiate education and no student loans. Back in 1989 that disparity was only 4 times higher. This puts the young college grad at a significant disadvantage — particularly, less cash for a home/vehicle purchase or starting a family. Notably, the ‘never married adults‘ chart nearly mirrors the debt to income ratio charts (see breakout in the early to mid 1980’s).

Herein, we find a significant burden on the median household wealth of the disadvantaged in the US are student loans. Because wealth is simply calculated as ‘assets minus liabilities’, there are many (20%) highly educated households who not only have low median net worth, but have a NEGATIVE net worth.

While income may be higher, household net worth remains limited for those laden with student loans.

At today’s costs, formal education should be regarded as a ‘very nice luxury’. Not unlike a new S-Class Mercedes, if you own it, profitable doors may open. Unfortunately, this strategy has simply not been proven to be profitable enough to close national wealth gaps. Herein, for the vast majority of graduates today, formal education is simply unaffordable with impact yet to be proven positive.

Lower cost options for education – comparable to community colleges, Udemy, or pH14 Investment Plan – should be considered as viable no-debt alternatives IFF the student pursues practical, experiential, volunteer programs (this is why pH14 Plan recommends virtual trading your options account successfully for at least a year or two).

‘Just Buy A House’

A commonly quoted contributor to net worth disparities in the US is homeownership. For the majority of Americans, a home is an otherwise unaffordable asset that therein requires a loan or requires debt to afford.

Debt alone, however, is not ‘bad’. To the contrary, leveraged investment vehicles – such as real estate – increase net worth faster because you have access to ‘other people’s money’. Moreover, when the asset appreciates in price, your gains aren’t capped to the proportion of your investment. While you likely own no more than a 10% of the home (based on your down payment), you get to have 100% of the capital gains on appreciation. Herein, when the asset rises in price, you benefit as if you owned the entire asset!

However, when used inappropriately, leveraged investment vehicles can decrease your net worth, faster. Why? Debts must be paid back, which may be unaffordable if the asset declines in price. For most people, the debt, by definition, is unaffordable – otherwise, they wouldn’t have taken out the loan in the first place.

“It doesn’t matter when you buy, the market will always bounce back…”, says the hopeful Real Estate investor who bought in 2006.

Eventually, even he will have to come to grips with reality.

People who purchased their home in 2005-2007 in the US, for the last 10 years have realized the magnitude of this error.

While purchasing a home during MOST years can add to our net worth over time, making a ‘blind’ purchase notwithstanding trends that may be changing, can be severely and irreversibly damaging to your net worth.

Real estate Investing for Beginners

How To Achieve HUNDREDS (Even Thousands) Of Percentage Gains In Your Investment Portfolio Close the Wealth Gap

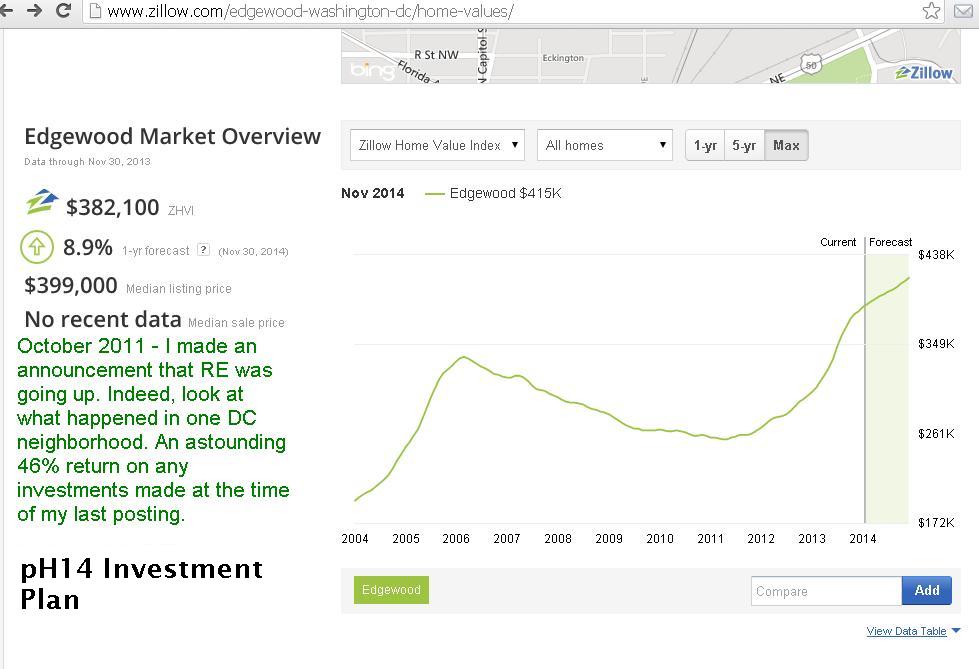

Back in October 2011, I alerted pH14 Plan community members (who at the time were all based in my local area) to the power move that was to come.

The call was indeed accurate.

As most know, Real Estate prices have really moved up significantly over the past five years.

Since then, in some DC neighborhoods, RE prices have surged 50%.

That means, your actual ROI *(on a 10% down payment in that neighborhood) would have yielded a maximal profit of about 500% or 6X from your initial down payment investment. On a 5% down payment, that’s a 1,000% to 12X return on your initial investment. Hmm….

Recall, the wealth gap is ‘only’ 10X at minimum…

Herein, improving net worth of an entire populace of people WILL NOT COME through blind recommendations to attend fancy schools – particularly, if the purchase of the education is mistimed. Improved net worth for an entire populace WILL NOT COME through blind recommendations to buy real estate – particularly, if the purchase of that real estate is mistimed. Justly, improved net worth for an entire populace won’t even come by working more. Just won’t.

Wealth gaps can close ONLY when the historically disadvantaged populace knows how to judiciously use leverage with a keen sense of precision and timing!

When utilized at the right time, leveraged purchases can be the necessary bridge to eliminate wealth gaps.

Charting, Like Your Life Depends On It

Charting real estate prices or charting a nation’s debt-to-income ratios from the perspective of a ‘technical analyst’ is unconventional, to say the least.

But it’s proved to be extremely useful for the pH14 Plan community.

While charting using the perspective of a technical analyst won’t ever make you wealthy, it may help you to avoid making poor investments and life altering decisions that could cripple your ability to live with the freedom most desire to have.

Conversely, if you are capable of identifying potentially new and emerging trends, you may be able to capture once in a lifetime opportunities that can positively impact not only your life, but your family, your community, and even unborn generations of lives to come after you.

Close the wealth gap.