New Republic published an article about the cause and effects of the retail sector breakdown.

The author suggests that real estate companies are exempt from proposed caps on interest payment deductions, which encourages high levels of debt that the author associates with crippling the business’ longevity, and enables the architect of the strategy to profit by selling off corporate assets or retaining ownership of various assets to be leased later when the original business eventually fails.

The article ends with attributing the corporate interests of the current Presidential administration to legislation, that would eventually profit the administration’s fellow investors and – in the author’s opinion – lead to a forecasted continued demise of the broader retail sector.

Certainly if you are interested in structuring buyouts of large failing companies, this might be a strategy you’ll want to learn and study.

But what are the implications for the rest of us ‘normal people’ who are seeking to manage our meager investment portfolio’s afforded through our $10 hourly compensation? Is there a lesson in all of this for the low income, low wealth worker?

We think that there is.

We’ve long held a thesis that you can forecast what sector may be significantly impacted by viewing the investments and allegiances of the United States President, and his family’s investments.

Let’s test that thesis.

Barack Obama was not known to be a high net worth investor prior to becoming the United States President, and neither is there any evidence that he was a high income earner. Before becoming the President, Mr. Obama worked as a community organizer, a professor, a non-partner lawyer – none of which were high paying jobs. His wife however, was the higher income earner, as a hospital / healthcare executive in Chicago.

If our thesis is that we should view the time and monetary investments of the President’s family, then the industry to which the Obama’s were most heavily invested with their time, money, and friendships was the healthcare industry.

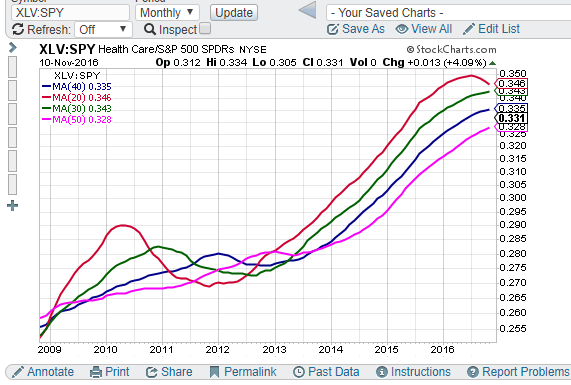

How did the healthcare industry do over the Obama years?

Households who invested in the healthcare industry performed much better than the market average during the Obama years.

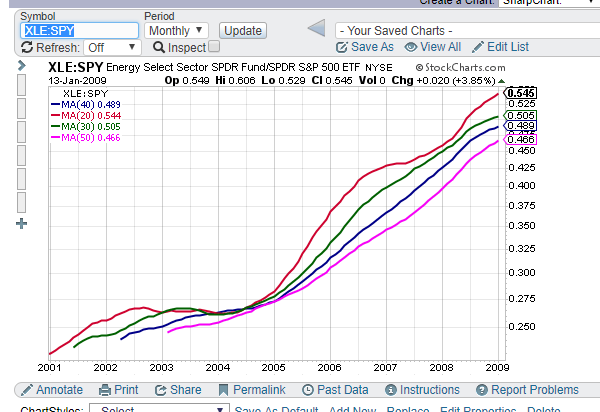

Let’s look at the previous United States President, George W. Bush. Where was his family most heavily invested with their time and money prior to him becoming the head of the Executive Branch of government? The answer was clearly, in the energy sector. He and his family actually started energy companies that according to his wikipedia page were “hurt by decreased oil prices” prior to his Presidency.

It makes sense then to assess what happened to the energy sector during his Presidency.

Portfolios invested into the energy sector significantly outperformed the broader market during the GW Bush presidency years.

Let’s view the Clinton family investments prior to his election to the Presidency. Mr. Clinton was not known to be a business executive. He had graduated from Law school in ’73 to become a professor. He was a State Rep by ’74, and by ’79 he was Governor – a meteoric rise. He was State Attorney General, then Governor again, prior to becoming the President. Like Mr. Obama, it is harder to align Mr. Clinton to any particular business or industry. In fact, Mr. Clinton said on NBC that he might have had the lowest net worth of any US President when he took office.

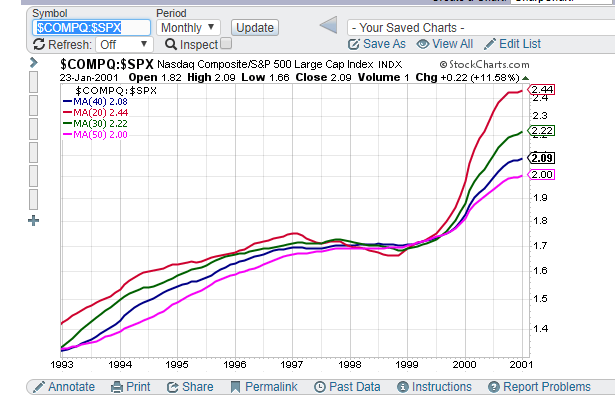

In this instance, it would have been much more difficult to forecast the affected industry… I think the investment lesson from the Clinton years, however, becomes more apparent when we see the career record of Clinton’s Vice President – – which would have also been a useful exercise during the GW Bush years. Clinton’s VP Mr. Al Gore infamously was credited by Internet pioneers as “the first elected official to grasp the potential of computer communications“. There’s even a wiki page entitled “Al Gore and Information Technology“.

How exactly did information technology companies perform during the Clinton Presidential administration???

As we might expect, the Nasdaq – an index of technology companies – outperformed the broader index of the largest 500 publicly traded companies in the US during the years that Mr. Clinton and his technology-friendly VP were in charge of the Executive branch of government.

One more…

George H.W. Bush was clearly invested in the energy sector. But as Director of the agency, what’s likely much more important is that he had likely begun establishing very critical corporate relationships across the broader markets well outside of energy sector… benefiting companies such as Coca Cola, who arguably had their best growth years ever while he was VP and President.

Quite literally, during the three Presidential terms (ie, 12 years) that he was in the White House as either VP or President, the broader market kicked-off one of its most robust bull markets.

In each of these retrospective assessments, you could nearly forecast the market effect and watch for entry opportunities for long term investments.

In what sector is Mr. Trump most deeply invested with corporate relationships prior to going to WH????

The current Presidential administration has visibly been well invested into the real estate industry, but his investments outside of real estate have also been lucrative.

Like everyone else, we’re watching the real estate sector, which at this moment is trending down compared to the broader market. Therefore, we are immediately more interested in watching the health and strength of broader markets.